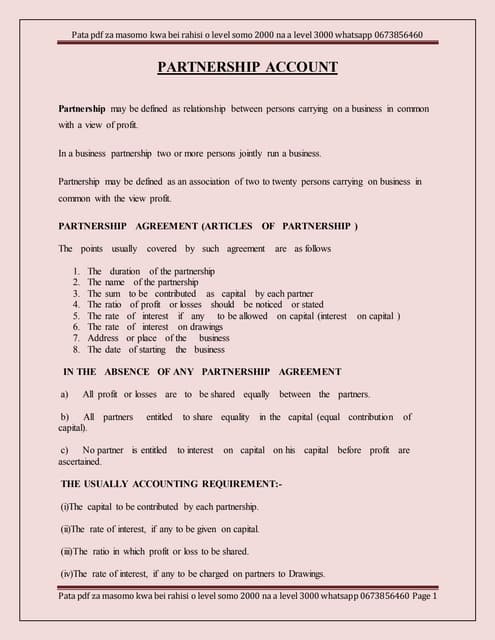

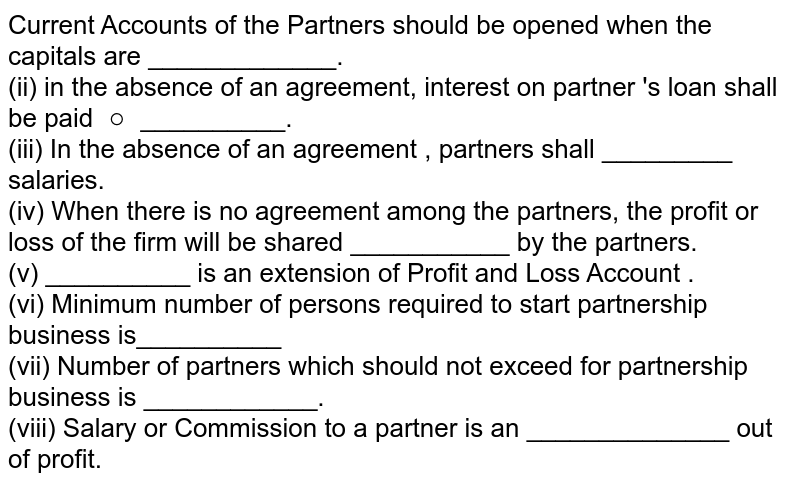

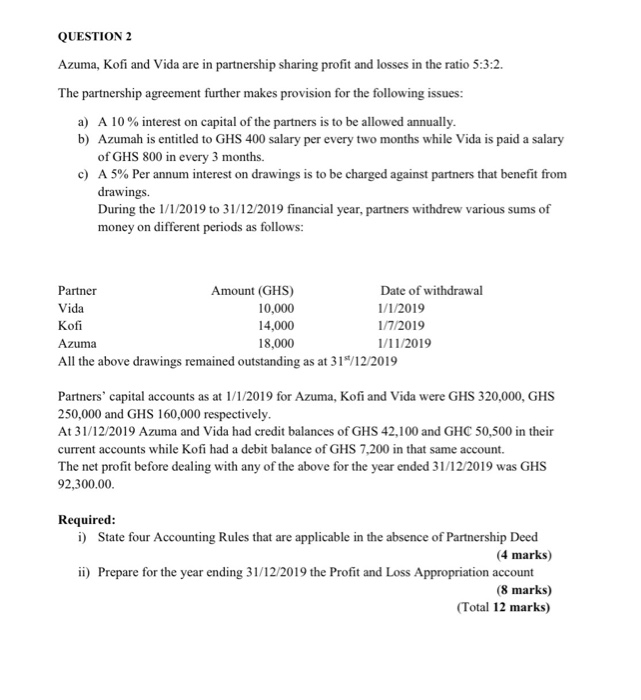

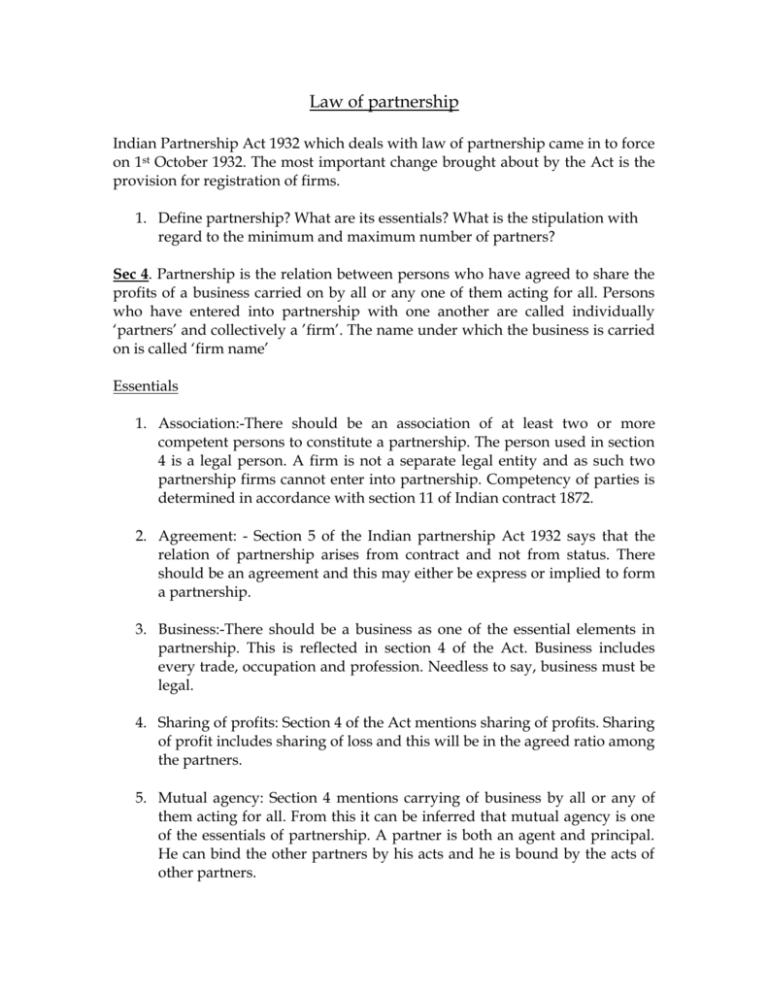

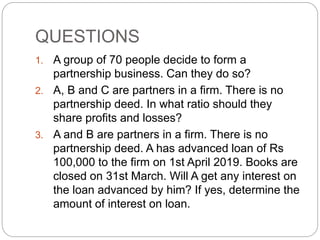

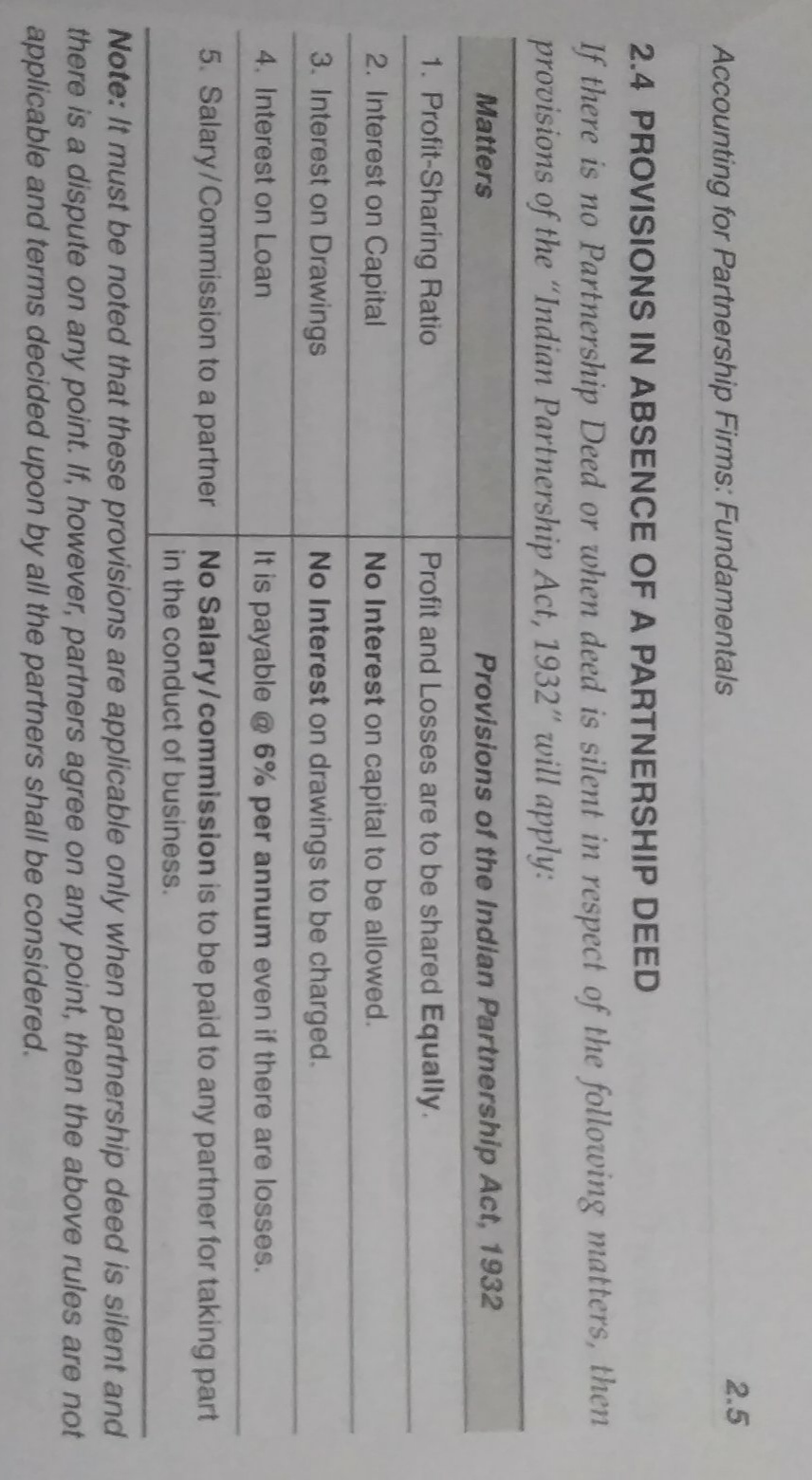

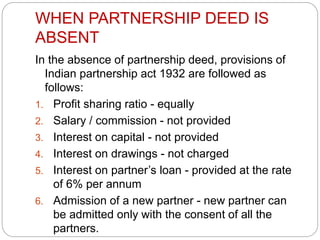

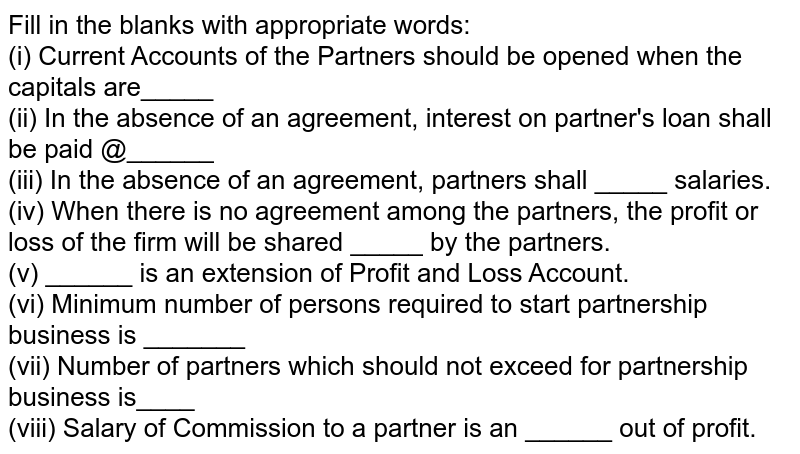

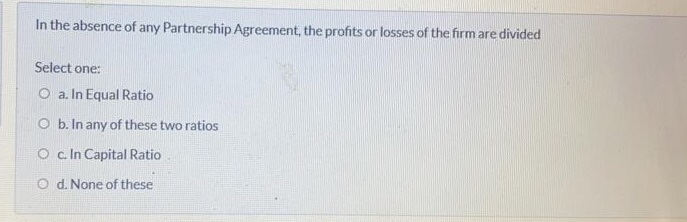

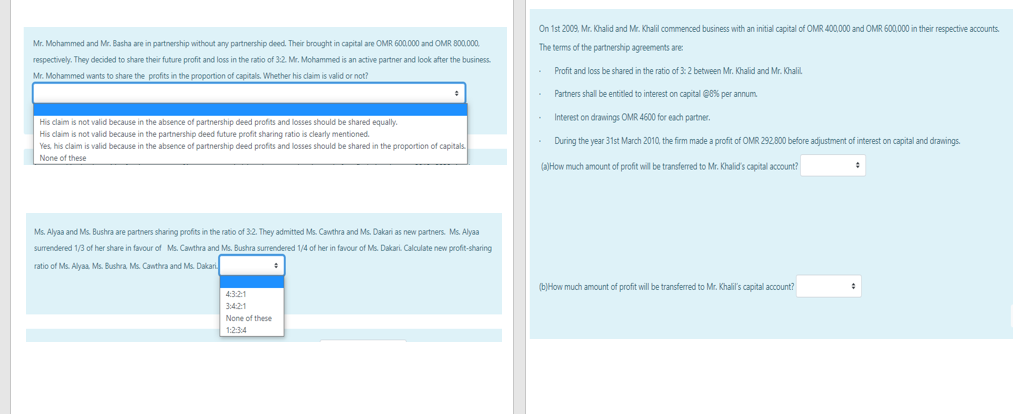

Web (iv) Interest on Partner's Loan In the absence of partnership deed if partner gives any loan to the firm he/she will be entitled to get a fixed percentage of interest onWebSolution (i) Sharing of profits and losses If the partnership deed is silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act of 1932,The nature of the company;

Partnership Deed Agreement Of Firm 15 Contents Format Types

In the absence of partnership deed rate of interest on partner loan will be

In the absence of partnership deed rate of interest on partner loan will be-Web In the absence of an agreement, the partnership act is applied However, the act leaves it to the discretion of partners to resolve disputes In case disputes ariseWebIn the absence of a partnership deed, the following rules have to be followed 1 The partners are entitled to share the profits or losses equally 2 Partners are not entitled to

How Does A Partnership Deed Look Like Quora

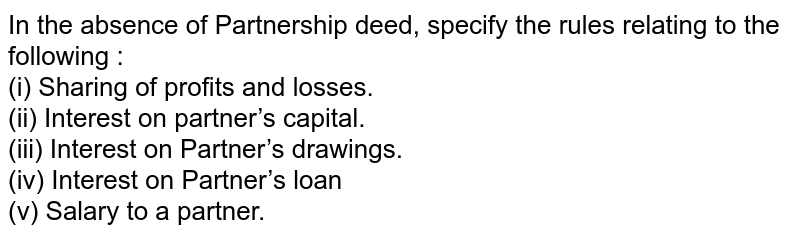

The amount of capital that each partnerWebNormally, a partnership deed covers all matters relating to mutual relationship among the partners But, in the absence of agreement, the following provisions of the IndianWeb In the absence of partnership deed the profit and loss arising from the partnership business is shared equally by the partners It is not shared according to

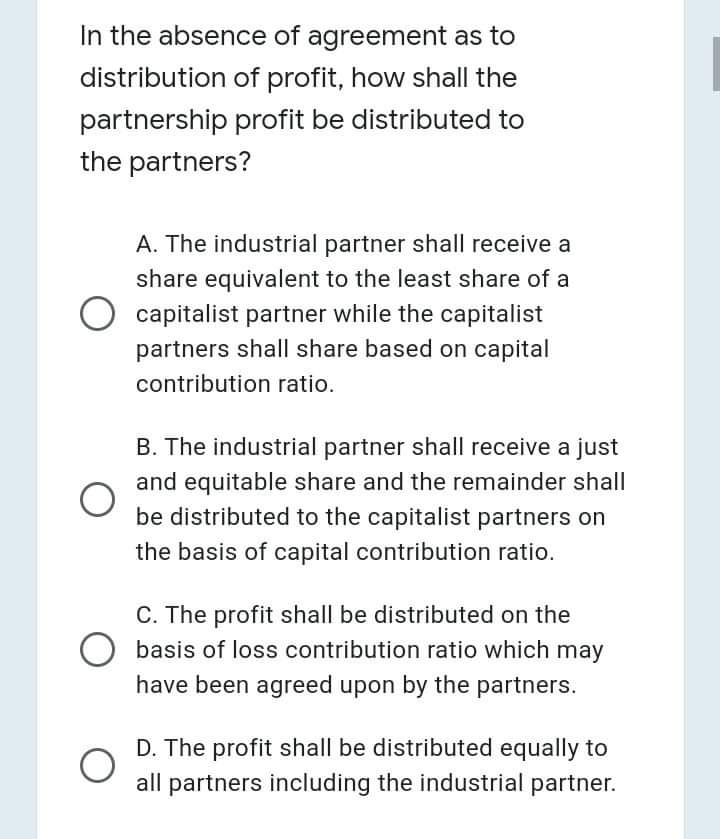

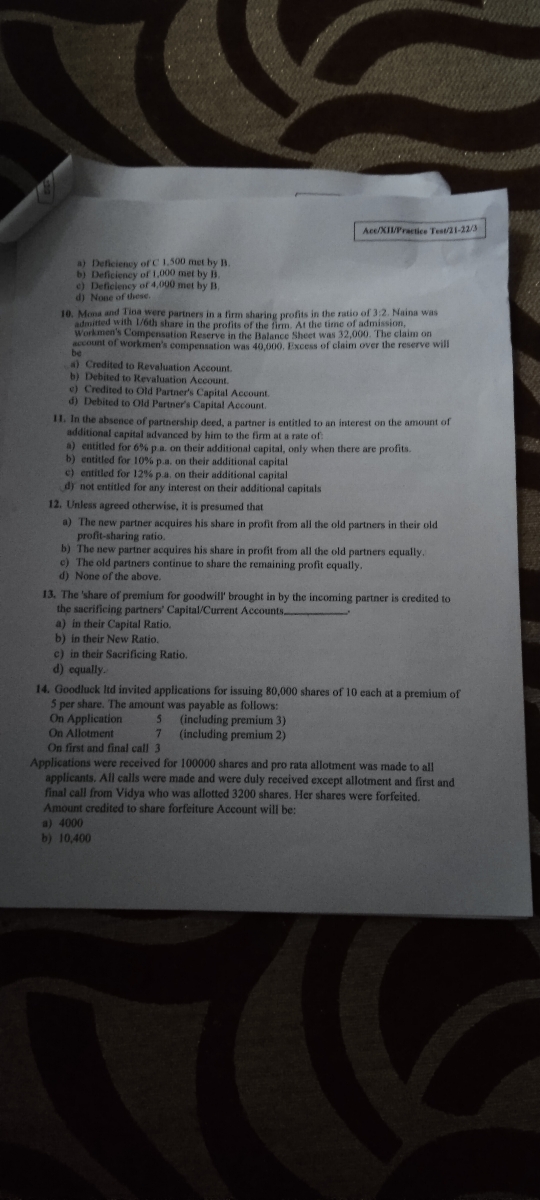

WebPartners Share of Profits In the absence of an agreement between the partners, they would share profits and losses equally among themselves (and not in the ratio of their capitalWebHere you can find the meaning of In the absence of partnership deed, the profit will be divided among partners a In the capital ratio b In equal ratio c In any ratio d Not in anyWebIn the absence of a partnership deed and where there is no indication as to the agreement between the partners in this aspect, it should be considered as equal share for all

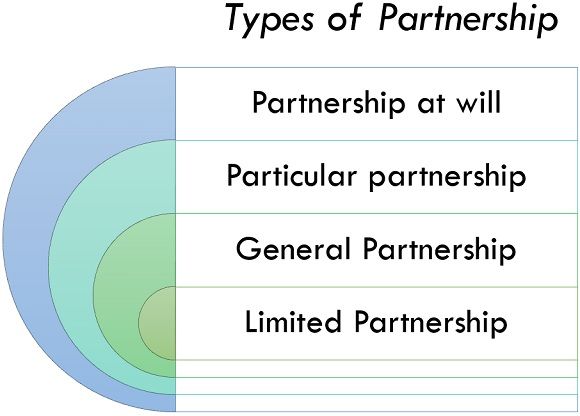

The Partnership's tenure or longevity;WebIn the absence of a partnership deed, the allowable rate of interest on a partners loan account will be A 4 % pa B 5 % pa C 6 % pa D 75 % pa Medium Solution Verified byWebIn the absence of a partnership deed, the following accounting rules apply A partnership deed includes all matters regarding the partners' mutual relationships The accounting

Partnership Fundamentals Pdf Interest Partnership

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

WebIn the absence of partnership deed, partnership firm will pay interest on loan at the rate of asked in Accounts by Ranjeet01 ( 591k points) fundamentals of partnershipThe partners' names and addresses;WebIn the absence of partnership deed, partners will get (a) Salary (b) Commission (c) Interest on loan and deposit (d) Sharing of profit in capital ratio class12 Share It On Facebook

.png)

Registration And Dissolution Of Firm Studymaterial Cpt Cpt Mercantile Laws The Indian Partnership Act 1932 Meritnation

How Does A Partnership Deed Look Like Quora

Web Solution In the absence of Partnership deed, the old partners will sacrifice in their old ratio ie equally CBSE Class 12 Accountancy Syllabus 19 & Important

Study Material Notes Partnership Fundamentals Sample Page Accounts Aptitude

Partnership Account

2nd Puc Accountancy Pratical Oriented Question How To Do You Treat Absence Partnership Deed 5marks Youtube

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks

Accounting For Partnership Notes Class 12 Accountancy

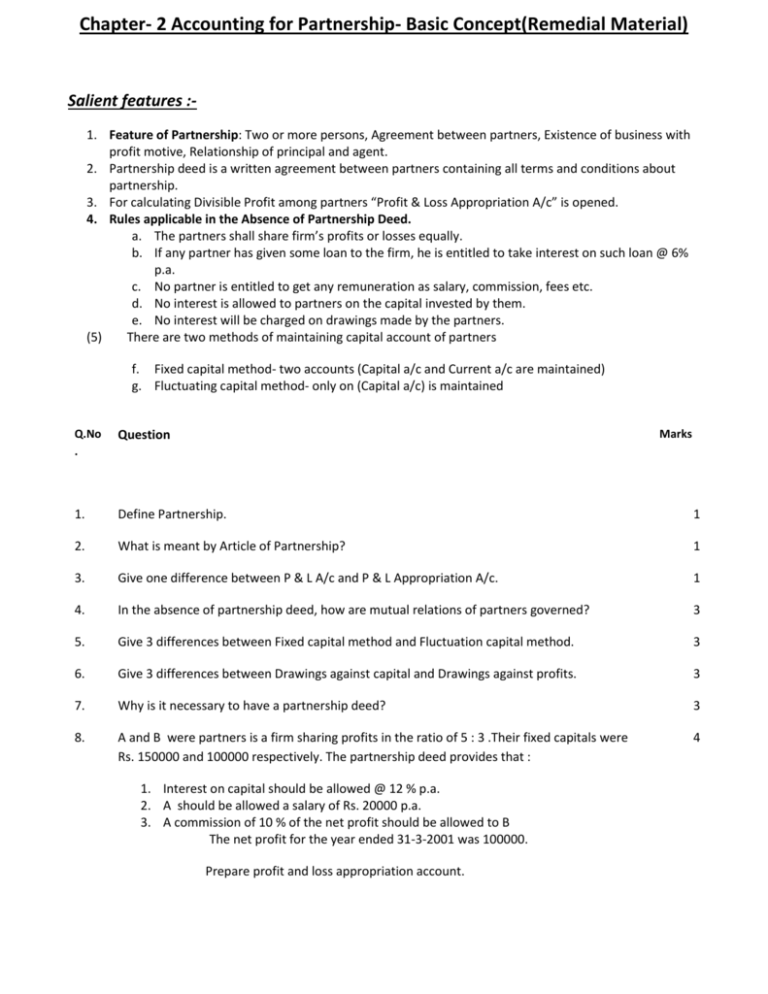

Doc Chapter 2 Accounting For Partnership Basic Concept Remedial Material Kelvin John Ramos Academia Edu

Answered In The Absence Of Agreement As To Bartleby

Partnership Deeds Meaning Contents With Solved Questions

Fundamental Of Partnership Accounts Seekho

In The Absence Of Any Partnership Agreement The Profit Or Loss Of

Solution Accounting For Partnership Studypool

Answered 10 Mona And Tina Were Partners In A Bartleby

Solution Accontancy Studypool

Arihant Mcq Term 1 Accountancy Pdf

Provision Of Partnership Act In The Absence Of Partnership Deed

Solved Question 2 Azuma Kofi And Vida Are In Partnership Chegg Com

Types Of Partners In Partnership Business Rights Duties Liabilities Of Partners

Page 14 Iscdebk 12

Exhibit103 Amendmentno4t

In The Absence Of Partnership Deed The Profits Of A Firm Are Divided Among The Partners A In The Ratio Of Capital B Equ Equality Previous Year Short Answers

Partnership Deed By Dhanya V L On Prezi Next

A B And C Take A Joint Life Policy After Fiveyears B Retires From The Firm Old Profit Sharing Ration Is 2 2 1 Afterretirement A And C Decide To

In The Absence Of Partnership Deed Specify The Rules Relating To The Following I Sharing Of Profits And Losses Ii Interest On Partner S Capital Iii Interest On Partner S Drawings Iv Interest

In The Absence Of Partnership Deed Partners Share Profits Or Losses Class 12 Accounting F Youtube

Partnerhip Partnership Deed Provisions In Absence Of Deed

Which Provisions Are Available For The Partners In The Absence Of The Partnership Deed Lawblog4u

Suresh Sahil And Sumit Are Partners Sharing Profits In The Ratio Of 5 3 2 During The Year Ended 31st March 18 The Firm Earned Profit Of Rs 3 50 000

Question 02 Chapter 2 Of 2 Part 1 Usha Publication 12 Class Part 1

Page 12 Iscdebk 12

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

Q Tbn And9gcr3ttmhad5ojjtvk393pi Duvm 0ya0kve61kdvfpdikg64dxlr 2ym Usqp Cau

Law Of Partnership

Partnership Deed Meaning Format Registration Stamp Duty

The Profit And Loss Sharing Ratio In Partnership Deeds Vakilsearch

Accounts14

Partnership Rules Faqs Findlaw

In The Absence Of Partnership Deed Youtube

In The Absence Of Any Provision In A Partnership Deed At What Rate Is A Working Partner Entitled For Remuneration Quora

Ahsec Class 12 Accountancy Question Bank Basics Of Partnership For 22 And 23 Exam

X Y And Z Are Partners Sharing Profits And Losses In The Ratio Of 5 3 2 From 1st April 18 They Decided To Share Profits And Losses Equally The Partnership Deed

Partnership Accounts Accounting Simpler Enjoy It

Partnership Deed Contents Features Benefits All You Must Know

Partnership Deed Agreement Of Firm 15 Contents Format Types

Solution Accountingfor Partnership Studypool

A Partnership Firm Earned Net Profit During The Last Three Years Ended 31 St March As Follows 16 Rs 17 000 17 Rs 000 18 Rs 23 000 The Capital Investment In

Ch 4 Admission Of A Partner Pdf

Partnerhip Partnership Deed Provisions In Absence Of Deed

All You Need To Know About Reconstitution Of A Partnership Firm Ipleaders

Solution Accounting For Partnership Studypool

Rules Applicable In The Absence Of Partnership Deed Youtube

Provision In Absence Of A Partnership Deed Accountancy Notes Teachmint

In The Absence Of Partnership Deed The Following Rule Will Apply Class 12 Accounting For Youtube

Partnerhip Partnership Deed Provisions In Absence Of Deed

Characteristics Of Partnership What Is A Partnership Pdf Partnership Law Of Agency

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

State The Provisions Of Partnership Act 1932 In The Absence Of A Partnership Deed Regarding I Interest On Partner S Drawings And Ii Interest On Advances Other Than Capital

Here We Have Discussed The Partnership Deed Its Content Partnership Deed Format And Everything You Need To Know About The Partnership Deed Or Agreement

Question 01 Chapter 2 Of 2 Part 1 Usha Publication 12 Class Part 1

The Partnership Act 1932

Q Tbn And9gcqjxwxse8ga7nyuafy Kzty9bytbczploycw J0ns2gkg47k6m Usqp Cau

Partnership Deed Class 12

Mcq Questions Class 12 Accountancy Accounting For Partnership

Accounting For Partnership

Support Material

Rules Applicable In The Absence Of Partnership Deed Youtube

Dk Goel Solutions Class 12 Chapter 2 Free Study Material

Pdf Xii Chap 1 Sanjivani Shinde Academia Edu

Partnership Deed Success Roar Classes

Asif And Ravi Are Partners In A Firm Sharing Profits And Losses In The Ratio Of 3 2 Their Fixed Capitals As On 1 St April 16 Were Rs 6 00 000 And Rs

Partnerhip Partnership Deed Provisions In Absence Of Deed

In The Absence Of Any Partnership Agreement The Profit Or Loss Of

Solved In The Absence Of Any Partnership Agreement The Chegg Com

Provisions Of Partnership Deed Indian Partnership Act 1932

Partnership Firm Rights And Duties Of A Partners Ebizfiling

Provisions Of Partnership Deed Vakilsearch Blog

Absence Of Partnership Deed Profit Loss Appropriation Goodwill Ca Cpt Cs Cma Foundation Youtube

Here We Have Discussed The Partnership Deed Its Content Partnership Deed Format And Everything You Need To Know About The Partnership Deed Or Agreement

Types Of Partnership Geeksforgeeks

Partnership Formation

Solution Accounting For Partnership Studypool

Page 17 Ma 12

Solution Accountancy Mcq 2 Studypool

Doc Name Of The Partnership Zeroes Academia Edu

Question 1 Chapter 2 Of 2 A T S Grewal 12 Class Part A Vol 1

Q Tbn And9gcsvak06kgfdqkjsxe Or4mfhbtxlr6qrqwplhgilw6r5atn0rh Lk V Usqp Cau

What Is Partnership Deed And What Are Its Main Contents

Q2 Elmuda

Solved On 1st 09 Mr Khalid And Mr Khalil Commenced Chegg Com

What Is Partnership Definition Types Partnership Deed And Characteristics The Investors Book

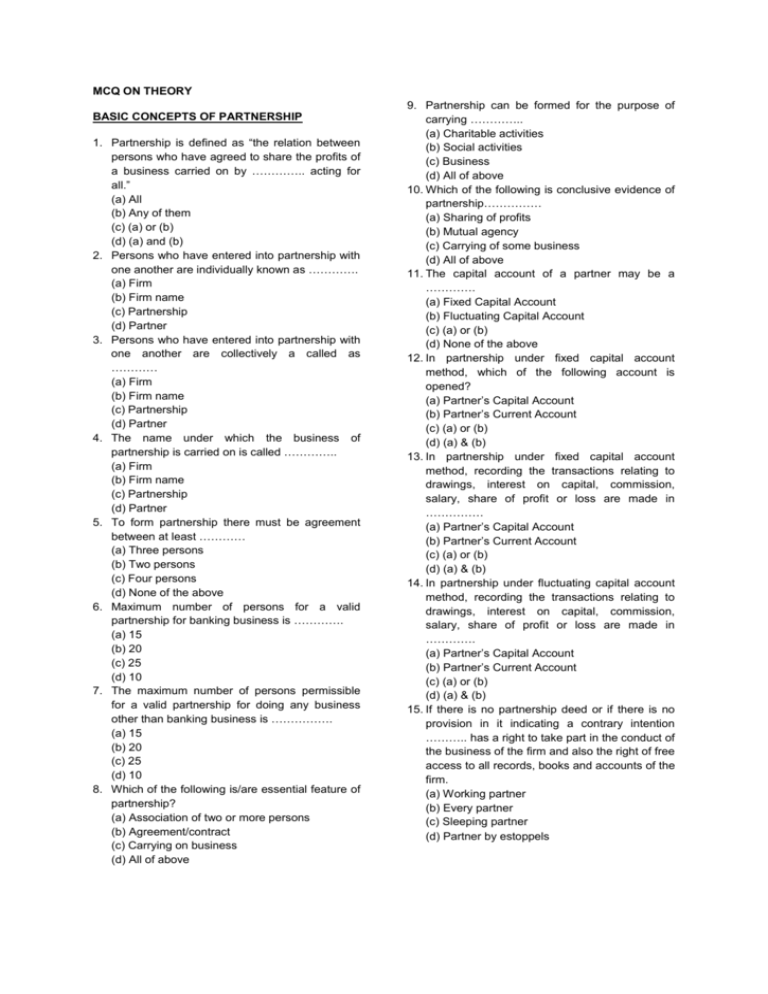

Mcq On Basics Of Partnership Multiple Choice Questions And Answers Partnership Accounts Mcqs Cma Mcq

Partnership Fundamentals Objective Type Mission Accountancy

Unacademy India S Largest Learning Platform

Partnership Accounts

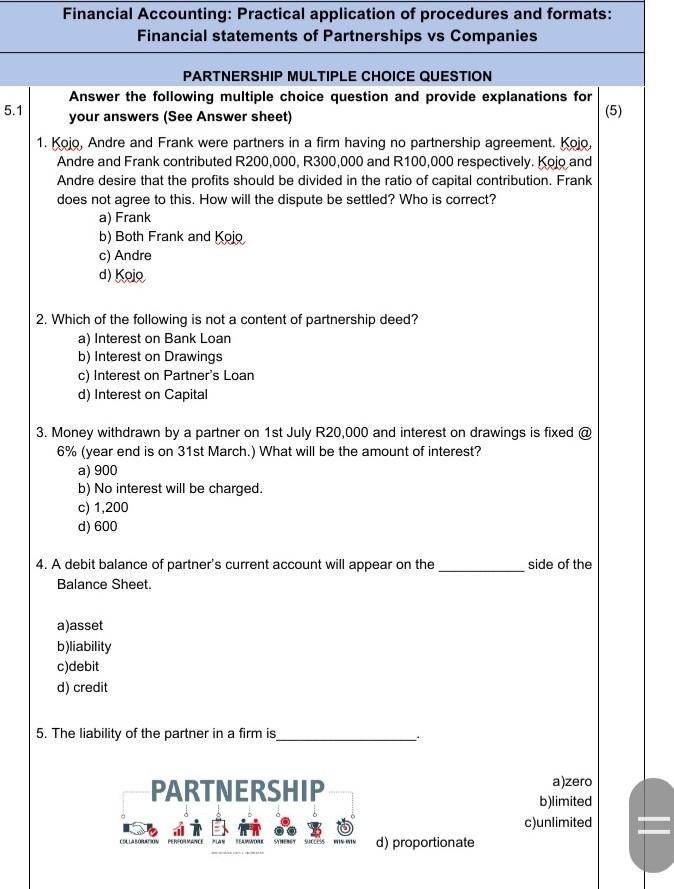

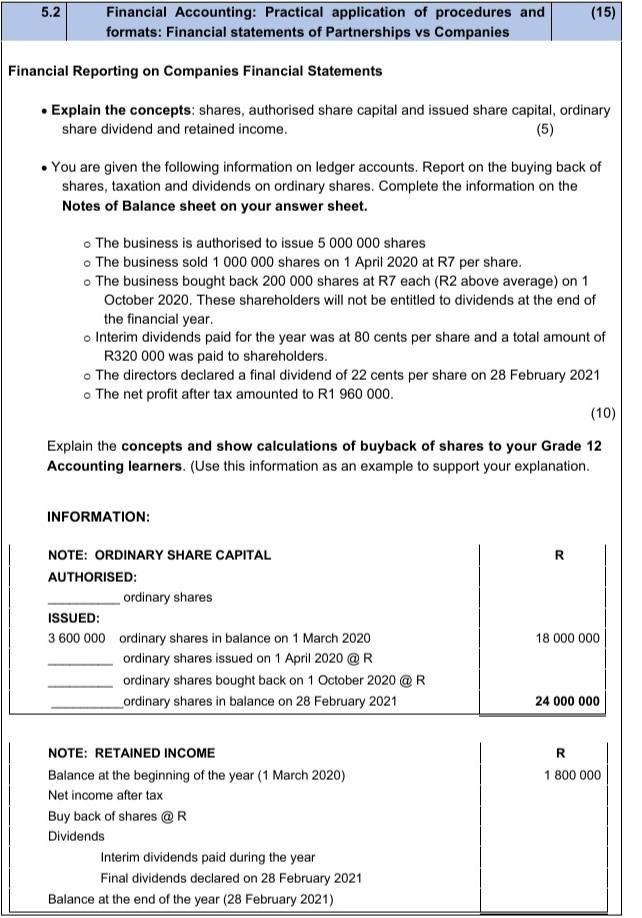

Solved Financial Accounting Practical Application Of Chegg Com

Doc Concepts Of Partnership And Partnership Deed Previous Years Examination Questions Topic 1 1 Mark Questions Roshan Sdfvadsfa Academia Edu

Solved Financial Accounting Practical Application Of Chegg Com

Partnerhip Partnership Deed Provisions In Absence Of Deed

In The Absence Of Partnership Deed Specify The Rules Relating To The Following I Sharing Of Profits And Losses Ii Interest On Partner S Capital Iii Interest On Partner S Drawings Iv Interest

0 件のコメント:

コメントを投稿